Selected chapters from the RTL Group Directors’ Report can be found here in digital form.

The complete Annual Report 2021 can be found here as a PDF flip catalogue.

RTL Group analyses key performance indicators (KPIs) to manage its businesses, including revenue, organic growth/decline, Adjusted EBITA, Adjusted EBITA margin, net debt, operating cash conversion rate and audience shares in main target groups. RTL Group’s key performance indicators are mostly determined on the basis of so-called alternative performance measures, which are not defined by IFRS. Management believes they are relevant for measuring the performance of the Group’s operations, financial position and cash flows, and for making decisions. These KPIs also provide additional information for users of the financial statements regarding the management of the Group on a consistent basis over time and regularity of reporting. These should not be considered in isolation but as complementary information for evaluating the Group’s business situation. RTL Group’s KPIs may not be comparable to similarly titled measures reported by other groups due to differences in the way these measures are calculated.

The organic growth is calculated by adjusting the reported revenue growth mainly for the impact of exchange rate effects as well as corporate acquisitions and disposals. It should be seen as a component of the reported revenue shown in the income statement. Its main objective is for the reader to isolate the impacts of portfolio changes and exchange rates on the reported revenue. When determining the exchange rate effects, the functional currency that is valid in the respective country is used. Potential other effects may include changes in methods and reporting.

EBIT, Adjusted EBITA and EBITDA are indicators of operating profitability. The key performance indicator for the operating profitability of RTL Group and its business units is Adjusted EBITA. Analysts also continue to use EBITDA as a KPI for the Group’s profitability. As a result, for these purposes the calculation of EBITDA for the Group is also disclosed.

RTL Group comments primarily on Adjusted EBITA as the KPI for measuring profitability.

Adjusted EBITA represents a recurring operating result and excludes significant special items. RTL Group management has established an ‘Adjusted EBITA’ that neutralises the impacts of structural distortions for the sake of transparency. Based on the accelerated industry trends explained in the Market section (pages 46 to 47) and Strategy section (pages 48 to 52) in this Directors’ report, RTL Group plans to increase its investments in business transformation including streaming, premium content, technology and data. At the same time, management is continually assessing opportunities to reduce costs in its traditional broadcasting activities, i.e. to reallocate resources from its traditional businesses to its growing digital businesses, which may lead to restructuring expenses that are neutralised in the Adjusted EBITA.

Adjusted EBITA is determined as earnings before interest and taxes (EBIT) as disclosed in the income statement excluding the following elements:

Significant special items exceed the cumulative threshold of €5 million, need to be approved by management, and primarily consist of restructuring expenses or reversal of restructuring provisions and other special factors or distortions. The adjustments for special items serve to determine a sustainable operating result that could be repeated under normal economic circumstances and is not affected by special factors or structural distortions.

In 2021, ‘Special items’ reflects the impact of restructuring expenses at RTL Deutschland (€–38 million), reversal of negative effects from onerous advertising sales contracts (€10 million) and the impact of expenses in connection with strategic portfolio management (€–33 million). In 2020, ‘Special items’ reflected the impact of a restructuring programme at RTL Deutschland (€–27 million) and onerous advertising sales contracts (€–10 million) as well as reversal of a provision at the Corporate Centre in Luxembourg (€3 million).

| 2021 €m | 2020 €m | |

| Earnings before interest and taxes (EBIT) | 1,908 | 903 |

| Impairment of goodwill of subsidiaries | – | 11 |

| Amortisation and impairment of fair value adjustments on acquisitions of subsidiaries | 19 | 14 |

| Impairment and reversals of investments accounted for using the equity method | (2) | 62 |

| Re-measurement of earn-out arrangements | – | 1 |

| Fair value measurement of investments | 115 | – |

| Gain/(loss) from sale of subsidiaries, other investments and re-measurement to fair value of pre-existing interest in acquiree | (949) | (172) |

| EBITA | 1,091 | 819 |

| Significant special items | 61 | 34 |

| Adjusted EBITA | 1,152 | 853 |

In accordance with RTL Group’s strategy, significant efforts were spent in growth businesses of streaming activities. Furthermore, the company is continuing to heavily invest in its streaming services RTL+ and Videoland with a rapidly increasing number of paying subscribers (for further details please refer to the section Building national streaming champions). Therefore, RTL Group discloses additionally the streaming start-up losses defined as total of Adjusted EBITA from RTL+, Videoland/RTL XL, Salto and Bedrock as consolidated on RTL Group level. For the year 2021, the total of streaming start-up losses amounted to €166 million (2020: €55 million). Considering this amount, the Adjusted EBITA before streaming start-up losses was €1,318 million (2020: €908 million).

The Adjusted EBITA margin as a percentage of Adjusted EBITA of revenue is used as an additional criteria for assessing business performance.

EBITDA represents earnings before interest and taxes (EBIT) excluding some elements of the income statement:

| 2021 €m | 20201 €m | |

| Earnings before interest and taxes (EBIT) | 1,908 | 903 |

| Depreciation, amortisation and impairment | 209 | 238 |

| Impairment of goodwill of subsidiaries | – | 11 |

| Amortisation and impairment of fair value adjustments on acquisitions of subsidiaries | 19 | 14 |

| Impairment and reversals of investments accounted for using the equity method | (2) | 62 |

| Re-measurement of earn-out arrangements | – | 1 |

| Fair value measurement of investments | 115 | – |

| Gain/(loss) from sale of subsidiaries, other investments and re-measurement to fair value of pre-existing interest in acquiree | (949) | (172) |

| EBITDA | 1,300 | 1,057 |

| 1 The figures from the previous year have been adjusted (see note 1.30. to the consolidated financial statements) | ||

The operating cash conversion rate (OCC) reflects the level of operating profits converted into cash available for investors after incorporation of the minimum investments required to sustain the current profitability of the business and before reimbursement of funded debts (interest included) and payment of income taxes. The operating cash conversion rate of RTL Group’s operations is subject to seasonality and investment cycles. RTL Group historically had – and expects in the future to have – a strong OCC due to a high focus on working capital and capital expenditure throughout the operations. OCC should be above 90 per cent in the long-term average and/or it should normally exceed market benchmarks in a given year.

OCC means operating free cash flow divided by EBITA, operating free cash flow being net cash from operating activities adjusted by the following elements:

| 2021 €m | 2020 €m | |

| Net cash from operating activities | 932 | 933 |

| Adjusted by: | ||

| Income tax paid | 437 | 248 |

| Transaction-related costs | 72 | – |

| Acquisitions of: | ||

| Programme and other rights | (88) | (60) |

| Other intangible and tangible assets | (107) | (118) |

| Proceeds from the sale of intangible and tangible assets | 2 | 2 |

| Operating free cash flow | 1,248 | 1,005 |

| EBITA | 1,091 | 819 |

| Operating cash conversion rate | 114% | 123% |

The net cash/(debt) is the gross balance sheet financial debt adjusted for:

In order to assess RTL Group’s leverage, the net debt to EBITDA ratio is used. The ratio is calculated as net debt divided by EBITDA.

| 31 December 2021 €m | 31 December 2020 €m | |

| Current loans and bank overdrafts | (49) | (124) |

| Non-current loans | (635) | (641) |

| (684) | (765) | |

| Deduction of: | ||

| Cash and cash equivalents | 547 | 436 |

| Cash pooling accounts receivable with investments accounted for using the equity method and not consolidated investments | – | 2 |

| Current deposits with shareholder and its subsidiaries | 794 | 563 |

| Net cash/(debt) | 657 | 236 |

| EBITDA | 1,300 | 1,057 |

| Net cash/(debt) to EBITDA ratio | n.a. | n.a. |

The net debt excludes current and non-current lease liabilities of €332 million (31 December 2020: €384 million).

In 2020, RTL Group applied a performance indicator for assessing the profitability from operations and return on invested capital, RTL Group Value Added (RVA). From 2021, RTL Group management decided to discontinue the application of this KPI.

Operating cost base is calculated as the sum of ‘Consumption of current programme rights’, ‘Depreciation, amortisation, and impairment’ and ‘Other operating expenses’.

| 2021 €m | 20201 €m | |

| Consumption of current programme rights | 2,512 | 2,070 |

| Depreciation, amortisation and impairment | 209 | 238 |

| Other operating expenses | 3,055 | 2,960 |

| Operating cost base | 5,776 | 5,268 |

| 1 The figures from the previous year have been adjusted (see note 1.30. to the consolidated financial statements) | ||

Dividend payout ratio means the absolute dividend amount divided by the adjusted profit attributable to RTL Group shareholders.

The absolute dividend amount is based on the number of issued ordinary shares at 31 December, multiplied by the dividend per share. The main adjustments on profit attributable to RTL Group shareholders refer to SpotX, Super RTL, Stéphane Plaza Immobilier, Eureka and VideoAmp.

| 2021 €m | |

| Profit attributable to RTL Group shareholders | 1,301 |

| Adjustments (from SpotX, Super RTL, Stéphane Plaza Immobilier, Eureka, VideoAmp) | 335 |

| Adjusted profit for the year attributable to RTL Group shareholders | 967 |

| from ordinary activities | 682 |

| from cash capital gains (from SpotX, Ludia and VideoAmp transactions1) | 285 |

| Dividend in € per share | 5.00 |

| from ordinary activities | 3.50 |

| from cash capital gains (from SpotX, Ludia and VideoAmp transactions1) | 1.50 |

| Dividend, absolute amount | 774 |

| Dividend payout ratio2 | ~80% |

| 1 Including non-cash gain for VideoAmp, for which cash proceeds are reflected in dividend as proceeds were received in the first quarter of 2022 2 Dividend, absolute amount/adjusted profit attributable to RTL Group shareholders | |

RTL Group estimates that the net TV advertising markets were up strongly across RTL Group’s key markets. A summary of RTL Group’s key markets is shown below, including estimates of net TV advertising market growth rates and the audience shares in the main target audience group.

| Net TV advertising market growth rate 2021 (in per cent) | RTL Group audience share in the main target group 2021 (in per cent) | RTL Group audience share in the main target group 2020 (in per cent) | |

| Germany | 6.0 to 6.51 | 26.32 | 27.52 |

| France | 16.13 | 22.84 | 22.74 |

| The Netherlands | 21.61 | 34.25 | 31.75 |

| Belgium | 11.91 | 34.16 | 36.16 |

| Hungary | 18.01 | 25.17 | 26.67 |

| Croatia | 20.11 | 23.88 | 27.08 |

| Spain | 8.39 | 27.410 | 27.810 |

1 Industry and RTL Group estimates

2 Source: GfK. Target group: 14−59

3 Source: Groupe M6 estimate

4 Source: Médiamétrie. Target group: women under 50 responsible for purchases (free-to-air channels: M6, W9, 6ter and Gulli)

5 Source: SKO. Target group: 25−54, 18−24h. Restated for a different audience measurement method, now excluding the screen use coming from devices such as hard disk DVD and video recorders

6 Source: Audimétrie. Target group: shoppers 18−54, 17−23h

7 Source: AGB Hungary. Target group: 18−49, prime time (including cable channels) 20−23h

8 Source: AGB Nielsen Media Research. Target group: 18−49, prime time 20−23h

9 Source: Infoadex

10 Source: TNS Sofres. Commercial target group: 25−59 | |||

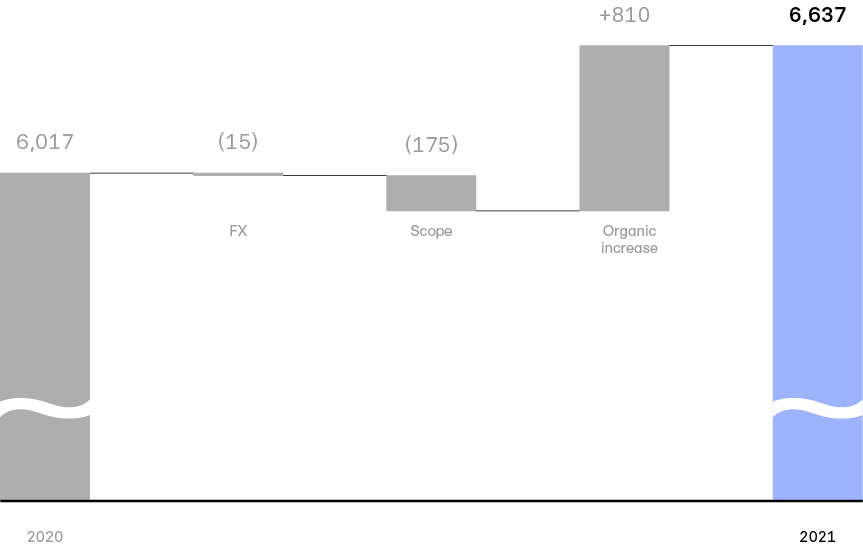

RTL Group’s total revenue increased 10.3 per cent to €6,637 million (2020: €6,017 million), mainly due to strong growth of TV advertising revenue in the second, third and fourth quarters of 2021, of Fremantle and of the streaming businesses. Group revenue was up 13.5 per cent organically. Foreign exchange rate effects had a negative impact of €15 million on revenue in 2021.

(in €million)

Streaming revenue – which includes SVOD, TVOD, in-stream and distribution revenue from RTL+ and Videoland/RTL XL – was up by 31.2 per cent, to €223 million (2020: €170 million).

RTL Group’s advertising revenue was €3,774 million (2020: €3,330 million), of which €3,057 million represented TV advertising revenue (2020: €2,636 million), €348 million represented digital advertising revenue (2020: €345 million) and €219 million represented radio advertising revenue (2020: €212 million).

RTL Group’s digital revenue was up by 2.7 per cent to €1,083 million (2020: €1,055 million). The effect of the disposals of BroadbandTV in 2020 and SpotX in 2021 was mainly compensated by Fremantle and higher streaming revenue.

Distribution revenue – generated across all distribution platforms (cable, satellite, internet TV) including subscription and re-transmission fees – was up 9.0 per cent to €437 million (2020: €401 million).

Digital revenue is spread over three different categories: digital advertising sales, revenue from distribution and licensing content, and consumer and professional services. In contrast to some competitors, RTL Group recognises only pure digital businesses as digital revenue and does not consider e-commerce, home shopping and distribution revenue as digital revenue. Revenue from e-commerce, home shopping and distribution is included in ‘revenue from selling goods and merchandise and providing services’ as stated in note 5.1. to the consolidated financial statements.

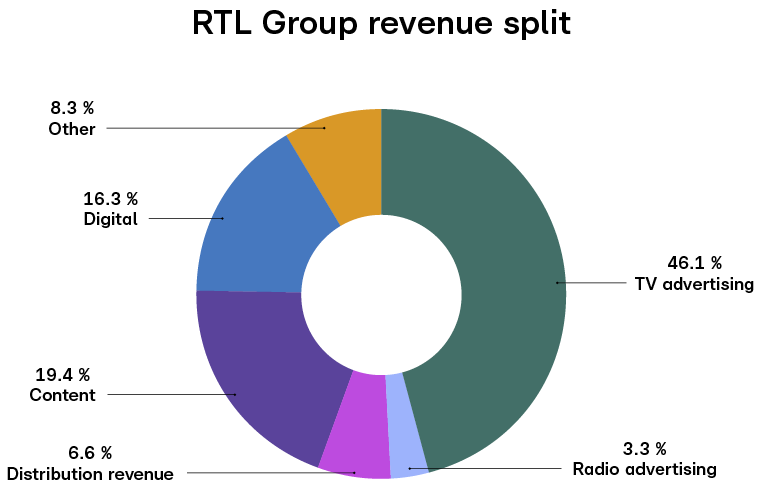

RTL Group’s revenue is well diversified, with 46.1 per cent from TV advertising, 19.4 per cent from content, 16.3 per cent from digital activities, 6.6 per cent from distribution revenue, 3.3 per cent from radio advertising, and 8.3 per cent from other revenue.

| 2021 €m | 2021 % | 2020 €m | 2020 % | |

| Germany | 2,241 | 33.8 | 1,958 | 32.5 |

| France | 1,392 | 21.0 | 1,242 | 20.6 |

| USA | 901 | 13.6 | 1,037 | 17.2 |

| The Netherlands | 610 | 9.2 | 497 | 8.3 |

| UK | 233 | 3.5 | 197 | 3.3 |

| Belgium | 203 | 3.1 | 187 | 3.1 |

| Other regions | 1,057 | 15.9 | 899 | 14.9 |

Adjusted EBITA was significantly up to €1,152 million (2020: €853 million). The Adjusted EBITA margin came in at 17.4 per cent (2020: 14.2 per cent).

For more detailed information and reconciliation of these measures see pages 56 to 57.

| 2021 €m | 2020 €m | 2019 €m | 2018 €m | 2017 €m | |

| Revenue | 6,637 | 6,017 | 6,651 | 6,505 | 6,373 |

| Adjusted EBITA | 1,152 | 853 | 1,156 | 1,171 | 1,248 |

| Net cash/(debt) | 657 | 236 | (384) | (470) | (545) |

| Operating cash conversion rate (in per cent) | 114 | 123 | 105 | 90 | 104 |

Group operating cost base increased to €5,776 million in 2021 (2020: €5,268 million), due mainly to increased programme costs at the Group’s broadcasting businesses and production costs at Fremantle.

The total share of results of these investments was €27 million (2020: €32 million).

Fair value measurement of investments of €–115 million (2020: nil) is mostly attributable to the negative valuation effects of the Magnite shares, partly compensated by valuation effects of the minority stake in VideoAmp.

In 2021, the Group recorded a gain of €949 million (2020: €172 million), mainly thanks to the disposals of SpotX and Ludia and positive effects of pre-existing interests in Super RTL and Stéphane Plaza Immobilier.

Financial result amounted to the expense of €–27 million (2020: expense of €–28 million). The comprehensive description on the financial result is disclosed in the notes 5.4. and 5.5. to the consolidated financial statements.

The Group has conducted impairment testing on the different cash generating units (see note a 6.2. to the consolidated financial statements).

The loss, totalling €19 million (2020: €25 million), relates to the amortisation of fair value adjustments on acquisitions of subsidiaries and in 2020 additionally to the impairment loss of goodwill allocated to We Are Era.

In 2021, the income tax expense was €427 million (2020: €250 million).

The profit for the year attributable to RTL Group shareholders was €1,301 million (2020: €492 million), mainly thanks to the capital gains of the disposals of SpotX and Ludia, positive effects of pre-existing interests in Super RTL and Stéphane Plaza Immobilier, and significantly higher Adjusted EBITA.

Earnings per share, based upon 154,742,806 weighted average number of ordinary shares, both basic and diluted, was up strongly to €8.41 (2020: €3.20 per share based on 153,586,913 shares).

RTL Group has an issued share capital of €191,845,074 divided into 154,742,806 fully paid-up shares with no defined par value.

Since 31 December 2020, the Group no longer holds treasury shares. All treasury shares were used as a part of the consideration paid to acquire non-controlling interests in RTL Belgium in 2020.

The annual accounts of RTL Group show a profit for the financial year 2021 of €70,963,534 (2020: €4,627,791). Taking into account the share premium account of €4,691,802,190 (2020: €4,691,802,190) and the profit brought forward of €249,050,821 (2020: €708,651,448), the amount available for distribution is €5,011,816,545 (2020: €5,405,081,429).

In April 2021, RTL Group sold its interests in SpotX to the US ad-tech company, Magnite. Since the announcement of the transaction on 5 February 2021, RTL Group exercised an option to increase the cash component of the transaction and received US-$ 640 million (€587 million) in cash and 12.37 million shares of Magnite stock.

In May 2021, Fremantle acquired a 26 per cent shareholding in Eureka through direct acquisition of shares and thus increased its total interest to 51 per cent by exercising a call option. As a result of obtaining control, the investment previously accounted for using the equity method is fully consolidated from the date of acquisition. The consideration transferred in terms of IFRS 3 was €24 million and comprises a purchase price payment of €2 million and the fair value of call option of €22 million.

In July 2021, RTL Deutschland acquired the outstanding 50 per cent shareholding in Super RTL from its former joint-venture partner, The Walt Disney Company, for a purchase price of €124 million. RTL Group’s shareholding in Super RTL is now 100 per cent.

In September 2021, Fremantle acquired 12 production labels from Nent Group – now called This is Nice Group – in Norway, Sweden, Finland and Denmark that operate across non-scripted, scripted and factual businesses, for a purchase price of €39 million.

In September 2021, Fremantle completed the sale of its 100 per cent shareholding in Ludia Inc. to US-based mobile entertainment company, Jam City, for US-$165 million (€146 million) in cash.

In December 2021, Groupe M6 finalised the acquisition of a 2 per cent stake in Stéphane Plaza Immobilier, in which it already held a 49 per cent shareholding, thereby assuming control of this network of franchised estate agents. The consideration transferred in terms of IFRS 3 was €3 million.

At 31 December 2021, the principal shareholder of the Group is Bertelsmann Capital Holding GmbH (BCH) (76.28 per cent). The remainder of the Group’s shares are publicly listed on the Frankfurt and Luxembourg Stock Exchanges. The ultimate parent company of RTL Group SA, Bertelsmann SE & Co KGaA, includes in its consolidated financial statements those of RTL Group SA.

The Group also has a related party relationship with its associates, joint ventures, directors and executive officers.

The comprehensive description on the related party transactions is disclosed in the note 10. to the consolidated financial statements.

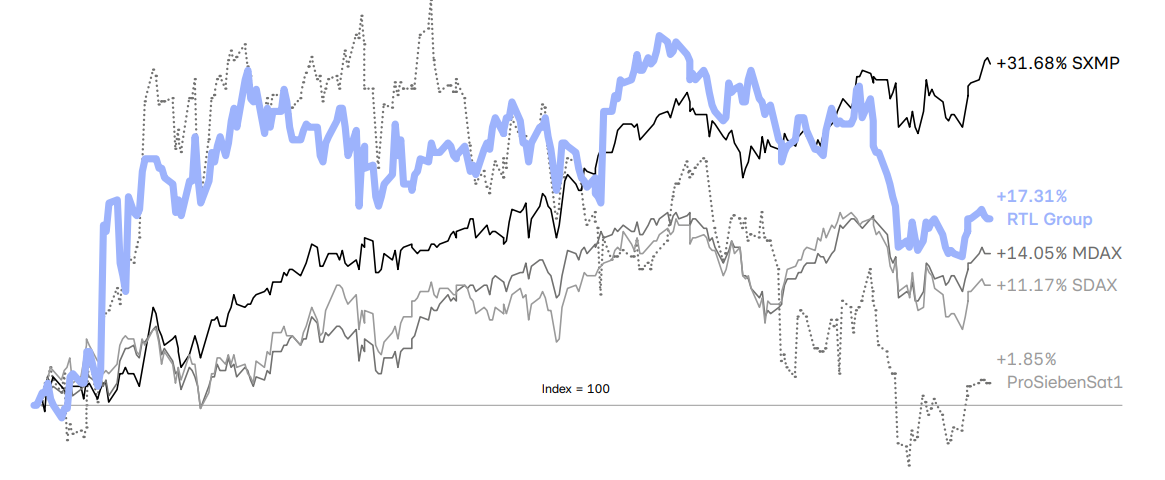

RTL Group’s shares (ISIN: LU0061462528) are publicly traded on the regulated market (Prime Standard) of the Frankfurt Stock Exchange and the Luxembourg Stock Exchange. From September 2013 to September 2020, RTL Group was listed in the MDAX stock index. Since then, RTL Group has been listed in the SDAX stock index. As of 21 March 2022, RTL Group will be re-included in the MDAX.

1 January 2021 to 31 December 2021 in per cent

RTL Group’s share price started 2021 at €39.74, finished the year up 17.3 per cent, at €46.62, thereby performing better than the German indices SDAX and MDAX. The share price highs and lows were €53.30 (27 August) and €39.26 (11 January). During 2021 the Group’s share continued to recover from the Covid-19 downturn.

Quarterly, the average share price evolved as follows:

Q1: €46.04

Q2: €49.20

Q3: €50.66

Q4: €48.35

The Group declared a dividend in April 2021 that was paid in May. The payment of €3.00 (gross) per share related to the 2020 full-year dividend. The total dividend paid amounted to €464 million. Based on the average share price in 2020 (€33.85), this represents a dividend yield of 8.9 per cent (2020: nil) and a dividend payout ratio of 80 per cent in line with the dividend policy.

For more information on the analysts’ views on RTL Group and RTL Group’s equity story, please visit the Investor Relations section on rtl.com.

In 2019, RTL Group decided to cancel its ratings from both S&P and Moody’s. Until the date of the cancellation, these ratings were fully aligned to RTL Group’s parent company, Bertelsmann SE & Co. KGaA, due to its shareholding level and control of RTL Group.

RTL Group’s dividend policy offers a pay-out ratio of at least 80 per cent of the Group’s adjusted net result.

The adjusted net result is the reported net result available to RTL Group shareholders, adjusted for any material non-cash impacts, such as goodwill impairments.

The share capital of the company is set at €191,845,074, divided into 154,742,806 shares with no par value.

The shares are in the form of either registered or bearer shares, at the option of the owner.

Bertelsmann has been the majority shareholder of RTL Group since July 2001. As at 31 December 2021, Bertelsmann held 76.28 per cent of RTL Group shares, and 23.72 per cent were free float.

There is no obligation for a shareholder to inform the company of any transfer of bearer shares save for the obligations provided by the Luxembourg law of 15 January 2008 on transparency requirements in relation to information about issuers whose securities are admitted to trading on a regulated market. Accordingly, the company shall not be liable for the accuracy or completeness of the information shown.

A detailed overview on the analysts’ views on RTL Group can be found on rtl.com.

| ISIN | LU0061462528 |

|---|---|

| Exchange symbol | RRTL |

| WKN | 861149 |

| Share type | Ordinary |

| Bloomberg code | RRTL:GR |

| Reuters code | RRTL |

| Ticker | RRTL |

| Transparency level on first quotation | Prime Standard |

| Market segment | Regulated Market |

| Trading model | Continuous Trading |

| Sector | Media |

| Stock exchanges | Frankfurt, Luxembourg |

| Last total dividend (for financial year 2020) | €3.00 |

| Number of shares | 154,742,806 |

| Market capitalisation1 | €7,214,109,615 |

| 52 week high | €53.30 (27 August 2021) |

| 52 week low | €39.26 (11 January 2021) |

| 1 As at 31 December 2021 |

RTL Group’s shares were/are listed in the indices with the weight as outlined below:

| Index | Weight in per cent | Date |

| SDAX | 2.4548 | 30/12/2021 |

| SDAX Kursindex | 2.4524 | 30/12/2021 |

| Prime All Share | 0.0951 | 30/12/2021 |

| HDAX | 0.0831 | 18/09/2020 |

| HDAX Kursindex | 0.0818 | 18/09/2020 |

As of 21 March 2022, RTL Group will be re-included in the MDAX.

The following outlook assumes that the economic recovery continues – mainly driven by private consumption – and that there is no significant impact from Covid-19 and the war in Ukraine. It is too early to quantify the potential impact of the war in Ukraine on consumer sentiment, inflation and economic growth – and thus on RTL Group’s results in 2022.

The outlook does not reflect the announced consolidation moves in France, the Netherlands and Croatia as they are still subject to regulatory approvals, but reflects the acquisition of Lux Vide by Fremantle (as of 3 March 2022) and the sale of RTL Belgium (as of end of March 2022)1.

16 March 2022

The Board of Directors

1 In addition, the outlook includes, among other scope effects, the deconsolidation of SpotX (as of 30 April 2021) and Ludia (as of 8 September 2021) as well as the full consolidation of Eureka (as of 17 May 2021), Super RTL (as of 1 July 2021), This is Nice Group (as of 30 September 2021) and Gruner + Jahr (as of 1 January 2022)

On this basis and subject to the above:

| 2021 | 2022e | |

| Revenue | €6,637m | ~€7.4bn |

| Adjusted EBITA | €1,152m | ~€1.15bn |

| Streaming start-up losses | €166m | ~€0.25bn |

| ‘Adjusted EBITA before streaming start-up losses’ | €1,318m | ~€1.4bn |

| 2021 | 2026e | |

| Paying subscribers | 3.804m | 10m |

| Streaming revenue | €223m | €1bn |

| Content spend per annum | €209m | ~€600m |

Profitability is expected by 20261.

1 Total of Adjusted EBITA from RTL+, Videoland/RTL XL, Salto and Bedrock as consolidated on RTL Group level. The Adjusted EBITA of RTL+ and Videoland/RTL XL includes synergies with TV channels on business unit level. For the definition of Adjusted EBITA please see Key performance indicators on pages 56 to 57.

Fremantle targets full-year revenue of €3 billion by 2025.

To reach this goal and keep up with the increasing demand for content, RTL Group will invest significantly in Fremantle – both organically and via acquisitions – in all territories across drama and film, entertainment and factual shows and documentaries.

The following sections give an overview about RTL Group’s reporting segments in 2021. RTL Deutschland (including RTL Radio Deutschland and Smartclip), Groupe M6 (including the French RTL family of radio stations), Fremantle and RTL Nederland. Other segments includes RTL Belgium, RTL Hungary, RTL Croatia, the US-based ad-tech company SpotX, and the digital video network We Are Era. It also includes RTL Group’s Luxembourgish activities and the investment accounted for using the equity method, Atresmedia in Spain.

| Revenue | 2021 €m | 2020 €m | Per cent change |

| RTL Deutschland | 2,425 | 2,127 | +14.0 |

| Groupe M6 | 1,390 | 1,273 | +9.2 |

| Fremantle | 1,926 | 1,537 | +25.3 |

| RTL Nederland | 575 | 476 | +20.8 |

| Other segments | 604 | 873 | (30.8) |

| Eliminations | (283) | (269) | |

| Total revenue | 6,637 | 6,017 | +10.3 |

| Adjusted EBITA | 2021 €m | 2020 €m | Per cent change |

| RTL Deutschland | 541 | 467 | +15.8 |

| Groupe M6 | 329 | 266 | +23.7 |

| Fremantle | 141 | 87 | +62.1 |

| RTL Nederland | 107 | 58 | +84.5 |

| Other segments | 33 | (25) | >100.0 |

| Eliminations | 1 | – | |

| Adjusted EBITA | 1,152 | 853 | +35.1 |

| Adjusted EBITA margin | 2021 per cent | 2020 per cent | Percentage point change |

| RTL Deutschland | 22.3 | 22.0 | +0.3 |

| Groupe M6 | 23.7 | 20.9 | +2.8 |

| Fremantle | 7.3 | 5.7 | +1.6 |

| RTL Nederland | 18.6 | 12.2 | +6.4 |

| RTL Group | 17.4 | 14.2 | +3.2 |

In the reporting period, the German net TV advertising market was estimated to be up between 6.0 and 6.5 per cent. RTL Deutschland’s revenue was up 14.0 per cent to €2,425 million (2020: €2,127 million), thanks to significantly higher TV advertising revenue and growing streaming revenue. Accordingly, Adjusted EBITA was up significantly from €467 million in 2020 to €541 million.

In 2021, the combined average audience share of RTL Deutschland in the target group of viewers aged 14 to 59 was 26.3 per cent (2020: 27.5 per cent), including the pay-TV channels RTL Crime, RTL Living, RTL Passion and Geo Television. The German RTL family of channels was ahead of its main commercial competitor, ProSiebenSat1, by 3.5 percentage points (audience share 2021: 22.8 per cent, 2020: lead of 3.6 percentage points).

With its portfolio of eight free-TV, four pay-TV channels and the streaming service RTL+, RTL Deutschland reached 28.9 million viewers every day in 2021 (2020: 30.3 million viewers).

With an audience share of 9.0 per cent in the target group of viewers aged 14 to 59 in 2021 (2020: 10.2 per cent), RTL Television was the leading commercial channel, ahead of Sat1 (6.7 per cent) and ProSieben (6.3 per cent), but behind the public channels ZDF (9.8 per cent) and Das Erste (9.1 per cent).

Let’s Dance was the channel’s most successful show in 2021. On average, 4.41 million viewers (15.8 per cent) aged three and above watched the 14th season, representing an average audience share in the commercial target group (viewers aged 14 to 59) of 17.5 per cent (2020: 19.0 per cent). The most watched programme was the German football match against Iceland on 8 September 2021, which attracted an average 7.34 million total viewers and a total average audience share of 28.9 per cent. The main news RTL Aktuell increased its average audience share in the commercial target group to 19.7 per cent, up 1.3 percentage points compared to 2020. On average the evening news was watched by 3.4 million total viewers. The late evening news format RTL Direkt was established successfully in the German news market with an audience share of 8.4 per cent in the commercial target group of viewers aged 14 to 59.

The streaming service RTL+ continued its rapid growth in 2021, more than doubling its number of paying subscribers, taking the total to 2.712 million (2020: 1.286 million). Viewing time increased by 47 per cent year-on-year, making RTL+ the leading German entertainment offering in the streaming market. This was thanks to the wide range of programmes available, including fiction series such as Sisi, Glauben and Faking Hitler. Are you the One – Realitystars in Love and Temptation Island VIP were the most-watched shows among RTL+ reality shows. The exclusive series Gossip Girl (2021), documentaries such as Stern Crime: Der Alptraummann and the TV show Kampf der Realitystars also attracted a large audience.

Vox achieved a stable audience share of 6.1 per cent in the target group of viewers aged 14 to 59 (2020: 6.1 per cent). Die Höhle der Löwen (Dragons’ Den) remained popular, generating an average audience share of 12.9 per cent among viewers aged 14 to 59, while Kitchen Impossible was watched by 10.4 per cent of the target group. Showtime of my Life – Stars gegen Krebs – awarded with Deutscher Fernsehpreis (German TV Award) – was another success for Vox. The two episodes were watched by 7.0 per cent of viewers ages 14 to 59. Furthermore, in the 14 to 49 target group, Vox was for the first time and then in total for four months, among the top three commercial channels (monthly ranking).

Nitro attracted 2.2 per cent of the 14 to 59 target group (2020: 2.1 per cent) and 2.9 per cent of its main target demographic of men aged 30 to 49 (2020: 2.6 per cent).

The news channel NTV scored a total audience share of 1.1 per cent and attracted 1.2 per cent of viewers aged 14 to 59 (2020: 1.2 per cent and 1.3 per cent).

RTL Up, previously RTL Plus, attained a 1.8 per cent audience share in the 14 to 59 age group, up 0.1 percentage points on 2020.

Super RTL retained its leading position in the children’s segment in 2021, attracting an average audience share of 21.0 per cent in the target group of three to 13-year-olds between 06:00 and 20:15, including Toggo Plus (2020: 20.7 per cent), ahead of the public service broadcaster KiKA (17.2 per cent).

In 2021, RTL Zwei attained a market share of 3.7 per cent among 14 to 59-year-old viewers (2020: 4.0 per cent).

Radio consumption in Germany remained strong in 2021, reaching 74.7 per cent of Germans aged 14 and above every day – with an average listening time of 259 minutes per day. RTL Group’s German radio portfolio reached 14 million Germans aged 14 and above every day. Many radio stations increased their reach, including Hitradio RTL Sachsen (with a growth of 29.8 per cent year-on-year among listeners aged 14 to 49) and 89.0 RTL, a station for younger listeners (growth of 10.2 per cent year-on-year among listeners aged 14 and above). 104.6 RTL maintained its market-leading position in the highly competitive Berlin/Brandenburg radio market in the target group of listeners aged 14 to 49.

Audio Now, one of Germany’s largest audio platforms, expanded its market position in 2021, with up to 7 million monthly users, and a portfolio of over 200 in-house productions developed by the podcast production company, Audio Alliance.

In 2021, the French net TV advertising market was estimated to be up 16.1 per cent compared to 2020, with Groupe M6 performing in line with the market. Groupe M6’s total revenue was up significantly by 9.2 per cent to €1,390 million (2020: €1,273 million). The increase in revenue was mainly due to higher advertising revenue. Accordingly, Groupe M6’s Adjusted EBITA was up by 23.7 per cent to €329 million (2020: €266 million).

The audience share of the Groupe M6 family of free-to-air channels in the commercial target group (women under 50 responsible for purchases) reached a record of 22.8 per cent (2020: 22.7 per cent). The total audience share was 14.3 per cent (2020: 14.6 per cent). On average, 25.1 million viewers watched Groupe M6’s free-to-air channels every day in 2021 (2020: 25.5 million).

Flagship channel M6 retained its status as the second most-watched channel in France in the commercial target group, with an average audience share of 14.7 per cent (2020: 14.4 per cent). Established entertainment brands such as L’Amour est dans le pré (The Farmer Wants a Wife), Top Chef and La France a Un Incroyable Talent (Got Talent) continued to attract high audience shares as did the broadcast of the Uefa Euro 2020 matches. The channel also introduced new favourites such as Appel à Témoins (Call to Witnesses), in collaboration with the Ministry of the Interior and the Ministry of Justice, Et si on se rencontrait (Love IRL) and the drama series Chernobyl. M6’s news shows Le 1245 and Le 1945, and magazines such as Enquête exclusive, Capital and Zone Interdite remained popular and played a major role during the ongoing Covid-19 crisis by providing reliable information.

The advertising-financed streaming service 6play continued to grow, with 28.5 million active users in 2021 (2020: 26.9 million active users). Viewing time was up 5.4 per cent to 530 million hours (2020: 503 million), mostly due to non-linear viewing of TV programmes from the M6 family of channels and by programmes exclusively licensed or produced for 6play.

W9 reached an average audience share of 3.8 per cent among women under 50 responsible for purchases (2020: 3.8 per cent), ranking it second among the DTT channels in France in this target group. Reality series, sports, movies, and magazines such as Enquête d’Action continued to score high ratings.

Among the new generation of DTT channels, 6ter remained the leader in the commercial target group for the fifth consecutive year, with an average audience share of 2.6 per cent (2020: 2.8 per cent).

With Gulli, Groupe M6 was the leader among the children’s target group (aged 4 to 10 years) during daytime (06:00 to 20:00), attracting an average audience share of 12.7 per cent (2020: 14.8 per cent). Every day, nearly 5 million viewers watch their favourite animated heroes, live-action series, games and documentaries, as well as fiction and movies for the whole family.

In 2021, the RTL radio family of stations registered a consolidated audience share of 18.2 per cent among listeners aged 13 and older (2020: 18.8 per cent). Its flagship station, RTL Radio, was the leading commercial station in France for the 18th consecutive year with an average audience share of 12.5 per cent (2020: 13.0 per cent). The pop-rock station RTL 2 recorded a stable average audience share of 3.0 per cent (2020: 2.9 per cent), while Fun Radio registered an average audience share of 2.8 per cent (2020: 2.9 per cent).

Revenue at RTL Group’s content business, Fremantle, was up by 25.3 per cent to €1,926 million in 2021 (2020: €1,537 million), with the delivery of the highend drama series American Gods (season three) and The Mosquito Coast. Revenue grew 15.8 per cent organically1 and Adjusted EBITA was up 62.1 per cent to €141 million (2020: €87 million).

In total, Fremantle delivered 81 scripted productions across drama, film and soaps in 13 languages in 2021, representing an increase of 42.1 per cent compared to 2020 (2020: 57). 2021 saw an increase in Fremantle’s film production, with seven movie releases (2020: 6).

The Hand of God – a movie directed by Paolo Sorrentino and produced by The Apartment – has been nominated for Best International Feature Film at the 2022 Academy Awards (The Oscars). The film was viewed over 12.7 million times during the first two weeks after its launch on Netflix in December 2021, with a global average audience of around 5.8 million. It was Netflix’s number one film in Italy in week 52 of 2021 and entered the weekly top ten in a further ten countries.

In the Nordics, Exit finished its second season, scoring record viewing figures of over two million per episode in Norway – a country of 5.4 million inhabitants. Holding the record for NRK’s most streamed drama ever, Exit has now sold to 119 territories.

The Investigation launched internationally in January 2021 on HBO, and in February 2021 in the UK on BBC2 after a successful domestic premiere on TV2 in Denmark in 2020. In the UK, the series about the investigation of the murder of the Swedish journalist Kim Wall launched with an audience share of 6.9 per cent of total viewers, making it the highest-rated non-English language drama in the UK for the 2020/21 season.

The UFA Fiction show Faking Hitler launched in December 2021 on RTL+ and was the second mostwatched scripted original on RTL+ that didn’t also air on another platform (linear TV or YouTube). A total 87 per cent of Faking Hitler views were generated by viewers aged 14 to 49. On 27 December 2021, Eldorado KaDeWe launched on ARD and the German public broadcaster’s Mediathek with an audience of 3.9 million viewers across both TV and streaming. With the whole series airing in one evening, KaDeWe performed 39 per cent higher than ARD’s time slot average for women aged 14 to 59 years.

American Idol’s 19th season, won an average audience of 7.1 million viewers and a market share of 9.3 per cent of total viewers, making it ABC’s number one entertainment series of the 2020/21 season. The 16th season of America’s Got Talent launched in June 2021 and scored an average audience share of 12.2 per cent for the season.

2021 also saw Fremantle shows reach wider audiences via online entertainment platforms. In October, China’s Got Talent was licensed to TikTok in China (known locally as Douyin) – the first time Fremantle has licenced a global format anywhere in the world. The show generated over 890 million views across the series.

The Masked Singer continued its success in 2021 with Fremantle responsible for the production of 16 series of the show across 14 territories, including four new markets (Armenia, Denmark, Sweden and Ukraine). In Sweden, The Masked Singer launched as the highestrated entertainment show premiere on TV4 for more than eight years, attracting a total average audience share of 51.4 per cent across the series.

Too Hot to Handle returned for a second season on Netflix in June 2021. The popular format was featured on Netflix’s top ten most-watched list in several countries a few days after its launch, and attracted an audience of 29 million within its first four weeks online. Celebrated by Ted Sarandos, Co-CEO and Chief Content Officer at Netflix as a ‘standout unscripted title’, localised adaptations of the show aired in Brazil in July 2021 and in Mexico in September 2021. After seven days of availability, the Latin American version achieved a top ten rank on Netflix in 27 countries.

For the first time in its 45-year history, Family Feud in the US was number one in daytime syndication, in both households and target group. Fremantle game shows dominated summer prime time on ABC with six series on air – Card Sharks, Celebrity Family Feud, Press Your Luck, To Tell The Truth, Supermarket Sweep and Holey Moley. The seventh series of Celebrity Family Feud was the highest-rated summer entertainment show on ABC, attracting an average audience of 5.4 million viewers which represents an average total audience share of 7.7 per cent. It was the number one show for the season in both household and the target group of viewers aged 25 to 54 years.

In Germany, UFA produced the documentary series Expedition Arktis, which follows the scientific expedition to undertake crucial climate research. The international version, Arctic Drift, has been sold to 170 territories.

In Italy, Fremantle launched its original series Veleno: The Town of Lost Children, with Amazon Prime Video. Written and directed by award-winning Hugo Berkeley, this factual series chronicles the true events of the Satanic Panic phenomenon, a decades-long saga of families torn apart.

Since May 2021, Fremantle has been in production with award-winning producer Richard Brown, his production company, Passenger, and sports-marketing company Infront, with an original documentary series telling the story of the launch and inaugural season of the Basketball Africa League, and produced documentaries including Ghislaine, The Prince and The Paedophile – a documentary about Ghislaine Maxwell for ITV in the UK – and Phat Tuesdays for Amazon Prime Video.

Fremantle also distributed several high-end documentaries in 2021, including the water-scarcity documentary, Day Zero, the Samuel L. Jackson-fronted seminal series, Enslaved, the Hulu docuseries, Von Dutch, and How it Feels to Be Free, which was executive-produced by Alicia Keys.

1 Adjusted for portfolio changes and at constant exchange rates. Further details can be found in Key performance indicators on page 56

In 2021, the Dutch net TV advertising market was estimated to be up by 21.6 per cent with RTL Nederland clearly outperforming the market. RTL Nederland’s total revenue increased by 20.8 per cent to €575 million (2020: €476 million). This resulted in a significantly higher Adjusted EBITA of €107 million (2020: €58 million).

In 2021, RTL Nederland's family of channels grew its combined prime-time audience share in the target group of viewers aged 25 to 54 to 34.2 per cent (2020: 31.7 per cent), thanks to a strong audience performance of the main channel RTL 4. As a result, RTL Nederland increased its lead over the public broadcasters – which also broadcast the European football championship – to 5.3 percentage points (audience share 2021: 28.9 per cent) and its main commercial competitor, Talpa TV (audience share 2021: 19.8 per cent).

RTL Nederland’s flagship channel, RTL 4, grew its average prime-time audience share in the target group of shoppers aged 25 to 54 to 21.6 per cent (2020: 18.7 per cent). The channel scored very high audience shares in this target group with the new show De Verraders (40.4 per cent), Make Up Your Mind (43.6 per cent), The Masked Singer (46.6 per cent), The Voice of Holland (30.4 per cent), Expeditie Robinson (34.4 per cent) and Lego Masters (37.5 per cent). The increase in audience share was also thanks to RTL 4’s current affairs programmes in early prime time with Editie NL (26.3 per cent) and RTL Boulevard (28.1 per cent). The main evening news show, RTL Nieuws, grew its average audience share in 2021 to 31.5 per cent (2020: 27.2 per cent).

RTL Nederland’s streaming service, Videoland, recorded subscriber growth of 20.9 per cent to 1.092 million paying subscribers at the end of 2021 (end of 2020: 0.903 million) while viewing time was up by 4.6 per cent year-on-year. Videoland’s growth was largely thanks to the third season of the series Mocro Maffia and the reality format Temptation Island, both of which are exclusive to Videoland in the Netherlands.

RTL 5’s prime-time audience share was 4.1 per cent in the target group of viewers aged 25 to 54 (2020: 3.9 per cent).

Men’s channel RTL 7 scored an average prime-time audience share of 5.8 per cent among male viewers aged 25 to 54 (2020: 5.3 per cent).

Women’s channel RTL 8 attracted an average prime-time audience share of 3.8 per cent among female viewers aged 35 to 59 (2020: 3.7 per cent).

RTL Z’s audience share in the demographic of the upper social status aged 25 to 59 decreased to 1.1 per cent (2020: 1.3 per cent).

This segment mainly comprises the fully consolidated businesses RTL Belgium, RTL Hungary, RTL Croatia, RTL Group’s Luxembourgish activities, RTL Group’s digital video company, We Are Era, and the global ad-tech company SpotX until 30 April 2021. It also includes its investment accounted for using the equity method, Atresmedia in Spain.

| Revenue split – Other segments | 2021 €m | 2020 €m | Per cent change |

| Total revenue of other segments | 604 | 873 | (30.8) |

| Thereof | |||

| SpotX (until 30 April 2021) | 56 | 164 | (65.9) |

| RTL Belgium | 176 | 159 | +10.7 |

| RTL Hungary | 116 | 105 | +10.5 |

| RTL Croatia | 46 | 40 | +15.0 |

| Other including elimination | 210 | 405 | (48.1) |

The net TV advertising market in French-speaking Belgium was estimated to be up 11.9 per cent in 2021. Accordingly, RTL Belgium’s revenue was up to €176 million (2020: €159 million). Adjusted EBITA more than doubled to €33 million (2020: €16 million), reflecting higher TV and radio advertising revenue.

RTL Belgium’s family of TV channels attracted a combined audience share among shoppers aged 18 to 54 of 34.1 per cent (2020: 36.1 per cent), maintaining its position as the clear market leader in French-speaking Belgium. RTL Belgium’s lead over the public channels decreased to 11.1 percentage points (2020: 15.5 percentage points), mainly since the public broadcaster aired the European football championship matches.

The flagship channel, RTL-TVI, had an audience share among shoppers aged 18 to 54 of 25.1 per cent (2020: 27.1 per cent) – 8.6 percentage points ahead of the Belgian public broadcaster La Une, and 12.6 percentage points ahead of the French broadcaster TF1. The broadcast of the Uefa Nations League game between Belgium and France was a great success, attracting an audience share of 71.3 per cent in the target group of shoppers aged between 18 and 54. Popular formats included Face au Juge with an average audience share of 46.0 per cent and L’amour est dans le Pré, which attracted an average audience share of 41.6 per cent in the commercial target group. The evening news show RTL Info 19h attracted an average audience share in the commercial target group of 40.3 per cent (2021: 43.3 per cent), continuing to reflect the strong interest in reliable news during the Covid-19 crisis and the flooding in Belgium in summer 2021.

RTL Belgium’s streaming service, RTL Play, performed strongly in 2021, with an average of 281,900 active users per month (2020: 200,400) and 37.7 million video views (2020: 18.6 million).

Club RTL’s audience share among male viewers aged 18 to 54 increased to 5.8 per cent (2020: 5.3 per cent), while Plug RTL reported a prime-time audience share of 4.3 per cent among 15 to 34-year-old viewers (2020: 4.4 per cent).

According to the CIM audience surveys for 2021 (January to September), Bel RTL and Radio Contact achieved audience shares of 12.7 and 12.9 per cent respectively, among listeners aged 12 years and over. In 2020 (January to December), audience shares reached 11.5 and 11.9 per cent respectively.

The Hungarian net TV advertising market was estimated to be up by 18.0 per cent in 2021 with RTL Hungary outperforming the market. Total revenue of RTL Hungary was up 10.5 per cent to €116 million (2020: €105 million) mainly due to higher TV advertising revenue. Accordingly, the business unit’s Adjusted EBITA increased to €13 million (2020: €8 million).

With a combined prime-time audience share of 25.1 per cent in the key demographic of 18 to 49-year-old viewers (2020: 26.6 per cent), the eight channels of RTL Hungary were 1.6 percentage points ahead of the main commercial competitor TV2 Group with 14 channels. Flagship channel RTL Klub reached a prime-time audience share of 13.9 per cent among viewers aged 18 to 49 (2020: 13.6 per cent) and remained the clear market leader, 2.8 percentage points ahead of TV2 (2020: 2.0 percentage points). The market-leading news programme, RTL Híradó, attracted 16.2 per cent of viewers aged 18 to 49 (2020: 18.1 per cent), and an average total audience share of 20.4 per cent (2020: 21.4 per cent) while Hungary’s strongest TV infotainment brand, Fókusz (Focus), achieved an average audience share of 14.2 per cent in the commercial target group. In 2021, political formats such as opposition primary debates of potential Prime Minister candidates attained successful ratings: the first debate attracted 16.4 per cent and the second debate 17.2 per cent in the commercial target group. This format also created a high level of interest on RTL Most.

The streaming service RTL Most is the leading local brand for professionally produced online video content. The service generated an increase of 17.9 per cent of registered users in 2021 compared to 2020.

In Croatia, the net TV advertising market was estimated to be up 20.1 per cent with RTL Croatia performing better than the market. Total revenue of RTL Croatia was up to €46 million (2020: €40 million), while Adjusted EBITA was up to €2 million (2020: €–2 million).

RTL Croatia’s channels achieved a combined prime-time audience share of 23.8 per cent in the target audience aged 18 to 49 (2020: 27.0 per cent). The flagship channel, RTL Televizija, recorded a prime-time audience share of 16.9 per cent of 18 to 49-year-olds (2020: 17.9 per cent).

Local content production remained a cornerstone of the channel’s programming. The year started with the European Men’s Handball Championship, which attracted an average audience share of 25.7 per cent across 21 live matches, while the match between Argentina and Croatia was watched by 55.7 per cent of 18 to 49-year-old viewers. Successful formats include Ljubav je na selu (The Farmer Wants a Wife), the second season of Brak na prvu (Married at First Sight) and Večera za pet na selu (Come Dine With Me – Village Edition). The late-night news format, RTL Direkt, scored an average audience share of 20.8 per cent in the target audience (2020: 21.4 per cent) while the main news format, RTL Danas, scored an average of 19.8 per cent (2020: 20.4 per cent).

RTL 2’s prime-time audience share was 5.3 per cent (2020: 6.6 per cent). The children’s channel, RTL Kockica, recorded an average audience share of 8.4 per cent (2020: 16.4 per cent) among children aged four to 14 between the hours of 7:00 and 20:00.

RTL Croatia’s streaming service RTL Play – the largest free streaming platform in Croatia – registered 14.4 million video views (2020: 16.3 million) from 1.2 million registered users (2020: 1.0 million).

In 2021, RTL Luxembourg confirmed its position as the leading media brand in the Grand Duchy of Luxembourg. Combining its TV, radio and digital activities (all three of which appear in the top-five media ranking in Luxembourg), the RTL Luxembourg media family achieved a daily reach of 82.1 per cent (2020: 82.1 per cent) of all Luxembourgers aged 15 and over.

Remaining the number-one station listeners turn to for news and entertainment, RTL Radio Lëtzebuerg reached 164,600 listeners each weekday (2020: 151,800). RTL Télé Lëtzebuerg – the only general-interest TV channel broadcast in Luxembourgish – attracted 138,700 viewers each day (2020: 153,000) and achieved a prime-time audience share of 48.0 per cent in the target group of Luxembourgish viewers aged 15 and over (2020: 50.3 per cent). rtl.lu, Luxembourg’s most visited website, has a daily reach of 52.4 per cent (2020: 46.7 per cent) of all Luxembourgers aged 15 and over.

In February 2021, RTL Luxembourg secured the rights to broadcast the world championships of FIA Formula 1 and MotoGP over a period of three seasons in Luxembourg. RTL Sport Live Arena – the digital platform for major team sports (football, basketball, volleyball, and handball) in Luxembourg – was launched in March 2021. RTL Luxembourg also started RTL Gold, the first Luxembourgish web radio station dedicated to the greatest hits of the 50s, 60s, 70s and 80s and RTL LX, a web radio station entirely dedicated to local talent. Launched in December 2020, RTL Play – the streaming service for audio and video content in Luxembourgish, French and English – recorded a total of 3.6 million plays during 2021.

In 2021, Broadcasting Center Europe (BCE) strengthened its position with remote production services, enhancing the video content of the French magazine l’Equipe with cloud-based solutions, as well as advanced global streaming services for sports federations. With the Start and Play broadcast solution, BCE maximised the playout footprint of the broadcasting family SECOM, among others. BCE also installed new studios for Radio Vinci in France and enabled the studio automation for RSI (Radiotelevisione Svizzera) and RTS (Radio Télévision Suisse) with its software, StudioTalk. BCE continued to operate its online video platform for Luxembourgish and European institutions, as well as major fashion brands.

After the combination of RTL Group’s digital video companies Divimove, United Screens, UFA X and RTL MCN – and the acquisition of Tube One Networks – Divimove was repositioned and rebranded as We Are Era. In 2021, We Are Era strengthened its leading positions in talent management, digital content production and influencer marketing, launched projects on TikTok for ZDF Sportstudio, started market-entry influencer campaigns for About You in Italy and Spain, and initiated successful branded-content campaigns for brands such as Coca-Cola. We Are Era also launched a dedicated Social Intelligence Hub providing unique audience and topic insights for productions, clients and talent. We Are Era’s revenue was up 10.7 per cent in 2021.

The Spanish net TV advertising market increased by an estimated 8.3 per cent in 2021. On a 100 per cent basis, consolidated revenue of Atresmedia was up 11.2 per cent to €963 million (2020: €866 million), operating profit (EBITDA) more than doubled to €173 million (2020: €74 million), and net profit was €118 million (2020: €24 million). The profit share of RTL Group was €22 million (2020: €4 million).The Atresmedia family of channels achieved a combined audience share of 27.4 per cent in the commercial target group of viewers aged 25 to 59 (2020: 27.8 per cent). The main channel, Antena 3, recorded an audience share of 13.8 per cent (2020: 11.4 per cent) in the commercial target group.

For more information on investments in associates please see note 6.5.2. to the consolidated financial statements in the RTL Group Annual Report 2021.

RTL Group believes that CR adds value not only to the societies and communities it serves, but also to the Group and its businesses. Acting responsibly and sustainably enhances the Group’s ability to remain successful in the future.

CR is integral to the Group’s strategy. With the recent portfolio changes and the announced consolidation moves in France, the Netherlands, Belgium, Germany and Croatia, the time had come to reposition the core RTL brand with a new identity, a clear set of brand principles and a new design reflecting the diversity at RTL. With this, RTL will be strengthened as Europe’s leading entertainment brand that stands for positive entertainment and independent journalism, as well as inspiration, energy and attitude. ‘We act responsibly’ is one of eight newly defined brand principles that guide the company’s action and define what RTL stands for. At the heart of RTL’s guiding principles and values is a commitment to embracing independence and diversity in its people, content and businesses.

RTL Group redefined its CR organisation in 2020. As part of this re-evaluation the Group decided to stop publishing its own Non-Financial Statement. The information of the Combined Non-Financial Statement (which complies with the European Directive 2014/95/EU and provisions by the law of 23 July 2016 regarding the publication of nonfinancial and diversity information in Luxembourg) can be found in the annual report of RTL Group’s majority shareholder, Bertelsmann SE & Co. KGaA. Further information on RTL Group’s non-financial information can also be found in the GRI reporting of Bertelsmann SE & Co. KGaA on bertelsmann.com.The RTL CR Board unites executives from RTL Group and RTL Deutschland and will be enlarged in 2022 following the combination of RTL Deutschland and Gruner + Jahr. The Board meets monthly to coordinate projects in key areas such as diversity, editorial independence and climate protection, to develop new ideas and to ensure efficient use of the expertise in both the Corporate Centre and RTL Deutschland.

The CR Board also meets annually with participants from specialist departments within RTL Deutschland, such as Youth Protection, the association Stiftung RTL, Communications, Facility Management and RTL Group (HR, Investor Relations, Compliance). The RTL Group CR Network – created in March 2014 and consisting of CR representatives from the Group’s profit centres – meets annually to share best-practices and knowledge. In addition, RTL Group established a Climate Task Force, consisting of members from all business units, who meet to discuss and collaborate to define actions to reduce CO2 emissions, with the target of becoming climate-neutral by 2030.

The summary covers key information on the following subjects: editorial independence, employees, diversity, society, intellectual property and copyright, information security, anti-corruption and anti-bribery, human rights and the environment.

RTL Group’s CR activities focus primarily on the following issues: content responsibility, creative/editorial independence and freedom of expression, intellectual property and copyright, fair working conditions, diversity and inclusion, health and well-being, learning (including digital media literacy) and climate change. These issues were identified in a materiality analysis in consultation with internal and external stakeholders. The core of the survey was the assessment of 19 CR topics – internally, according to their relevance for the business, and externally, according to their relevance for stakeholders. The survey was conducted in 2020 in close consultation with the Group’s majority shareholder Bertelsmann.

RTL Group’s broadcasting and news reporting are founded on editorial and journalistic independence. RTL Group’s commitment to impartiality, responsibility and other core journalistic principles is articulated in its Newsroom Guidelines. Maintaining audience trust has become even more important in an era when news organisations and tech platforms have been accused of publishing misleading stories, and when individuals, radical political movements and even hostile powers post fake news on social networks to sow discord.

For RTL Group, independence means being able to provide news and information without compromising its journalistic principles and balanced position. Local CEOs act as publishers and are not involved in producing content. In each news organisation, editors-in-chief apply rigorous ethical standards and ensure compliance with local guidelines, which gives the Group’s journalists the freedom to express a range of opinions, reflecting society’s diversity and supporting democracy.

RTL Group has a diverse audience and a business based on creativity, and the Group therefore needs to be a diverse organisation. In 2021, the Group had an average of 10,861 full-time employees (total headcount: 17,650 including permanent and temporary staff) in more than 30 countries worldwide. They range from producers and finance professionals to journalists and digital technology experts.

RTL Group strives to be an employer of choice that attracts and retains the best talent, and equips employees with the necessary skills and competencies to successfully master the company’s current and future challenges. It does this by offering training programmes and individual coaching in a wide range of subjects, from strategy and leadership to digital skills and health and well-being. It reviews and, if necessary, adjusts its training offers on an ongoing basis.

RTL Group’s corporate culture is founded on creativity and entrepreneurship. The Group strives to ensure that all employees receive fair recognition, treatment and opportunities, and is committed to fair and gender-blind pay. The same applies to the remuneration of freelancers and temporary staff, ensuring that such employment relationships do not compromise or circumvent employee rights. The Group also strives to support flexible-working arrangements.

The Covid-19 crisis and various lockdown measures have deeply changed the world of work. In 2021, RTL Group continued to offer flexible work from home options to all employees who could work from home and whose function did not require their presence at the office. It also introduced hybrid work solutions.

In 2021, RTL Group conducted its bi-annual employee survey with a response rate of 81 per cent. This corresponds to 7,795 respondents from 74 companies across 23 countries and in 11 languages (excluding temporary workers and Groupe M6). Compared to the 2019 survey, RTL Group achieved higher scores and only positive deviations, particularly for CR-related topics, communication from senior management, engagement, and supporting the company’s strategy. Since 2021, the employee survey includes a new CR Index, to help track the progress of RTL Group-wide CR initiatives.

1 Calculation based on the average of positive responses to six questions of the 2021 Employee Survey in the following categories: Health & well-being; Diversity, Equity & Inclusion; Fair working conditions; Learning; Climate change

RTL Group’s commitment to diversity is embedded in its processes and articulated in its corporate principles. The cornerstone is the RTL Group Diversity Statement that reinforces the company’s commitment to promoting diversity and ensuring equal opportunity. It sets guidelines and qualitative ambitions for the diversity of the Group’s people, content and businesses.

RTL Group is committed to making every level of the organisation more diverse with regard to nationality, gender, age, ethnicity, religion and socio-economic background. The Group places a special emphasis on gender diversity. RTL Group’s workforce overall is balanced by gender (with 50 per cent men and 50 per cent women as at 31 December 2021) while women account for 28 per cent at top management positions (31 December 2020: 24 per cent), and 24 per cent of senior management positions (31 December 2020: 24 per cent).

Top management generally encompasses the members of the Executive Committee, the CEOs of the business units and their direct reports, members of the Management Boards, and the Executive Committee direct reports at RTL Group’s Corporate Centre. Senior management generally encompasses the Managing Directors of the businesses at each business unit, the heads of the business units’ departments and the Senior Vice Presidents of RTL Group’s Corporate Centre (unless classified as members of top management).

RTL Group’s long-term ambition is for women and men to be represented equally at all levels. In 2019, RTL Group’s Executive Committee reviewed the Group’s objectives and set the following quantitative target for 2021: to increase the ratio of women in top and senior management positions to at least one third. At the end of 2021, the ratio of women in top and senior management positions was 25 per cent, up 5 percentage points compared to 2016 when RTL Group reported those measures for the first time (2016: 20 per cent). The Group did not achieve the gender diversity goal it set for 2021. Among the reasons for this were changes to the Group’s portfolio of companies. In January 2021, RTL Group’s Executive Committee reviewed the Group’s objectives and set the following quantitative targets: to increase the share of women in top and senior management positions to at least one third by the end of 2022 and 40 per cent by the end of 2025. The Group reports on its progress towards these diversity targets each year.

The importance of diversity is also reflected in the content the Group produces. Millions of people who turn to RTL Group each day for the latest local, national and international news need a source they can trust. RTL Group therefore maintains a journalistic balance that reflects the diverse opinions of the societies it serves. The same commitment to diversity applies to the Group’s entertainment programming: it is essential for RTL Group to create formats for a wide range of audiences across all platforms. Content needs to be as representative as possible of the diversity of society, so that many different segments of society can identify with it.

In 2021, Fremantle continued to make progress towards building an equitable and inclusive culture across its business and content, and appointed a Group Head of Diversity, Equity and Inclusion to accelerate these issues.

In the US, Fremantle is working with the Hollywood Bridge Fund, a scheme that trains and connects below-the-line, under-represented workers to job opportunities in Hollywood and helps broaden the diversity of the hiring pool. In the UK, Fremantle partnered with the TV collective to help create a mentoring initiative called Breakthrough Leaders to develop a mentoring programme designed to support 50 Black, Asian and minority-ethnic future leaders. In Germany, UFA made a commitment to becoming more diverse both in front of and behind the camera. UFA’s full-year programming portfolio aims to reflect the diversity found in society by the end of 2024.

Inclusive casting and storylines across Fremantle shows continued to provide a platform for different voices and perspectives that reflect and celebrate the world we live in, influence authentic storytelling, and promote empathy and understanding. In Italy, X Factor went gender neutral for its 15th season. The four teams of performers formed with no distinctions based on gender, age or even whether they were a solo artist or band. In the UK, Fremantle’s format Five Guys A Week expanded with a brand new six-part series, Five Dates A Week (working title), which will involve single people of any gender and sexual orientation trying out the UK’s most unique matchmaking set-up.

As a leading media organisation and broadcaster, RTL Group has social responsibilities to the communities and audiences it serves. These responsibilities are particularly serious when it comes to children and young people. The Group complies fully with child-protection laws and ensures its programming is suitable for children – or broadcast when they are unlikely to be viewing. RTL Group also strives to give back to its communities by using its profile to raise awareness of, and funds for, important social issues, particularly those that might otherwise receive less coverage or funding.

As part of this support, the Group provides free airtime worth several million euros to charities and non-profit organisations to help them raise awareness of their cause, as well as donating significant amounts of money to numerous charitable initiatives and foundations. Finally, RTL Group’s flagship fundraising events (Télévie in Belgium and Luxembourg, and RTL-Spendenmarathon in Germany) raised €34,175,495 for charity in 2021 (2020: €27,129,150).

RTL Group’s primary mission is to invest in high-quality entertainment programmes, fiction, drama, news and sports, and to attract new creative talent to help the Group contribute to a vibrant, creative, innovative and diverse media landscape. Strong intellectual property rights are the foundation of RTL Group’s business, and that of creators and rights-holders.

RTL Group’s Code of Conduct was updated and adapted to the latest developments in 2021 and now includes a new, user-friendly speak-up system, and an Information Security Policy that sets a high standard for the protection of intellectual property. All employees are expected to comply with copyright laws and licensing agreements and to put in place appropriate security practices (password protection, approved technology and licensed software) to protect intellectual property. Sharing, downloading or exchanging copyrighted files without appropriate permission is prohibited.

The foundation for lasting business success is built on integrity and trustworthiness, and RTL Group has zero tolerance for any form of illegal or unethical conduct. Violating laws and regulations – including those relating to bribery and corruption – is not consistent with RTL Group’s values and could damage the Group. Non-compliance could harm the Group’s reputation, result in significant fines, endanger its business success and expose its people to criminal or civil prosecution.

The Compliance department provides Group-wide support on anti-corruption, anti-bribery, and other compliance-related matters. In addition to centralised management by the Compliance department, each business unit has a Compliance Responsible in charge of addressing compliance issues, including anti-corruption.

For information about RTL Group’s Audit Committee see page 86 of RTL Group’s Annual Report.

Representatives of RTL Group management sit on the RTL Group Corporate Compliance Committee. The committee, which is chaired by RTL Group’s Chief Financial Officer, is responsible for monitoring compliance activities, promoting ethical conduct and fighting corruption and bribery. It is kept informed about ongoing compliance cases and the measures taken to prevent compliance violations.

The RTL Group Anti-Corruption Policy is the Group’s principal policy for fighting corruption. It outlines rules and procedures for conducting business in accordance with anti-corruption laws and Group principles.

Respect for human rights is a vital part of RTL Group’s Code of Conduct, which includes a decision-making guide that clarifies how to comply with the company’s standards in case of doubt. The Group’s commitment to responsible and ethical business practices extends to its business partners. In 2017, RTL Group established the RTL Group Business Partner Principles, which sets minimum standards for responsible business relationships. To report suspected human-rights violations or unethical practices, employees and third parties can contact RTL Group’s compliance reporting channels (directly or through a web-based reporting platform) or an independent ombudsperson. In all cases, they may do so anonymously.

RTL Group is a media company with no industrial operations and therefore does not consume significant amounts of raw materials or fossil fuel and is not a major polluter. The Group is mindful that resource conservation and climate protection are key challenges for the 21st century. For this reason – together with employees and in dialogue with various stakeholders – RTL Group is committed to minimising its impact on the environment, by reducing its energy use and its direct and indirect greenhouse gas (GHG) emissions. It codified this commitment in February 2018 by issuing its first Environmental Statement.

RTL Group has measured and published its carbon footprint since 2008. Serving as the key indicator for evaluating and continually improving the Group’s climate performance, it was formerly calculated based on each country’s average energy mix. To improve data quality, since 2017 it has been calculated based on the emissions associated with the Group’s individual electricity supply contracts. This new, more detailed baseline takes into account hotel stays, refrigerant losses, commuting, IT devices and own and commissioned productions, as well as electricity consumption, paper, business travel, water and wastewater.

At the start of 2020, RTL Group decided to become carbon neutral by 2030. It will reach this goal in two steps. By 2025, the Group will be carbon neutral with regards to company-related CO2 emissions. Here, the focus will be on switching to green electricity, reducing business travel and offsetting the remaining emissions. By 2030, the Group will reach full carbon neutrality with regards to the emissions from the production of its programmes and products.

As part of its aims to reduce carbon emissions, Fremantle collaborated with Bafta’s Albert to launch a carbon calculator and certification toolkit for the TV industry in January 2021. The toolkit is an authority on environmental sustainability, allowing carbon emissions caused by content productions to be calculated and, above all, provides a controlled way of reducing them.

In April 2021, the German advertising sales house, Ad Alliance, joined the Green GRP initiative, which aims to offset the carbon dioxide emissions produced by campaigns with certified climate protection projects.

In November 2021, BCE inaugurated the largest groundbased solar panel park in Luxembourg, in partnership with energy supplier Enovos. The panels will produce around 10.5 gigawatt hours of electricity per year – enough to power more than 2,800 households.

For RTL Group’s environmental indicators according to GRI standards please visit rtl.com.

Innovation at RTL Group focuses on three core topics: continuously developing new, high-quality TV formats; using all digital distribution channels; and better monetisation of the Group’s audience reach using personalisation, recommendations and addressing target groups.

In 2021, RTL Group launched a new identity and design for its core brand, RTL. The comprehensive redesign and repositioning of RTL was started to strengthen RTL as Europe’s leading entertainment brand. Within this project, the German streaming service was rebranded to RTL+ (formerly TV Now). RTL Group also announced the expansion of RTL+ into a cross-media entertainment service, comprising video, music, podcasts, audio books and e-magazines, which will be a unique selling proposition in the German-speaking market, starting in 2022. The cross-media extension is the first example of the synergies to be realised following the combination of RTL Deutschland and Gruner + Jahr. The service’s innovative recommendation algorithm based on smart text, audio and video analysis will ensure users are offered personalised content suggestions across all types of media.

Another innovative focus point is addressable TV advertising, which combines the broad reach of linear TV with targeted digital advertising. In October 2021, RTL Group and Amobee – a global leader of advertising technologies – announced the formation of TechAlliance. This comprehensive cooperation will be a joint sales and services company for the ad-tech solutions of Amobee and Smartclip, which is part of RTL Deutschland. TechAlliance will be the first European-wide offering for programmatic access to addressable TV advertising.